Establishment of Company In Turkey

Establishment of Company In Turkey

Company formation turkey 2021©- With the new foreign investor programme, the Republic of Turkey grants citizenship to foreigners who make 250,000 dollar property investment in Turkey or found/buy a company with 500,000 dollar capital, or deposit 500,000 dollars in State investment instruments or state banks operating in Turkey provided that they do not withdraw such amount for three years. Turkish Citizenship By İnvesment

Company formation in Turkey

In the global age, companies tend to re-consider their capital structures within the Capital, Information and Technology axis. There is no doubt that adaptation to the increasing international competition within the boundaryless world plays an important role in the decision to establish overseas businesses and partnerships. Within this perspective, Turkey develops a series of legal and political initiatives that encourage the internationalization and globalization efforts of companies who seek to move to Turkey. This article explains the process of establishing a foreign company in Turkey by focusing on ordinary procedures for establishing different types of foreign companies.

Establishing company legal basis

Core legislation on foreign investment is the Law no 4875 on the Foreign Direct Investments.[1] Upon its acceptance and entry into force on 17.06.2003, the current legislation on Foreign Direct Investment explicitly guarantees two principles: freedom to establish business enterprises and equal treatment. In accordance with article 3 (a) of Law on Foreign Direct Investments:

“Unless stipulated by international agreements and other special laws: 1.Foreign investors are free to make foreign direct investments in Turkey, 2. Foreign investors shall be subjected to equal treatment with domestic investors.”

Prior to entry into force of Law no 4875, foreign investors seeking to establish business in Turkey were subjected to Law no 6224 on the Encouragement of Foreign Capital. In accordance with the old legislation which is outlawed by the Law no 4875, Foreign companies were subjected to a series of strict opening procedures. Among all the most controversial ones were the requirement of preliminary permission from Ministry of Treasury and a minimum 50.000 USD capital requirement per foreign partner. Moreover Law no 4875 also abolished the limitation before the commercial activities of foreign investors. Previously, foreign investors were allowed to form Joint Stock Companies, Limited Liability Companies and Branch Offices. By the virtue of Law no 4875 and most importantly by the reforms put forward by the new Turkish Commercial Code, regardless of having a legal entity, foreign investors might form all types of companies and engage commercial activities in Turkey.

Business life in Turkey was further amended by the introduction of the new Turkish Commercial Code No. 6102, which has replaced and outlawed the 55 years old Turkish Commercial Code on 1 July 2012.[2] In line with the European Union harmonization efforts the new commercial code created a well structured and less complicated business life. Moreover it reflected major EU principles such as free movement of capital.

Among all, one of the major developments achieved by the introduction of the new code is the amendment of the shareholder structure of companies. Accordingly the new law permits the establishment of joint stock companies or limited companies with a single shareholder. Furthermore, foreign individuals may form a joint stock company or a limited company. In the joint stock companies, the board of directors can be formed only by one person and the board may also meet in an electronic environment. Moreover legal entities may be appointed as board members. Thus foreign individuals or legal entities can form a joint stock company and board members might consist of foreign nationals.[3]

Required documents for establishing a company in Turkey

As in establishment of any company, basically the company’s trade name, scope of the field of activity, headquarters, director/representative, capital and shares must be determined. It is required to open a bank account based on the Potential Tax ID and deposit 1/4 (25%) of the New Partnership Capital (depending on the type and capital amount of the company) in this account. It is also required that notarized copies of the company documents are registered in the central registry system and an application is made to the related trade registry office together with the following documents:

- Chamber of Commerce registration application,

- Founding statement form,

- Articles of Association certified by Notary Public,

- If the foreign partner is a real person; notarized translation of passport and potential tax number,

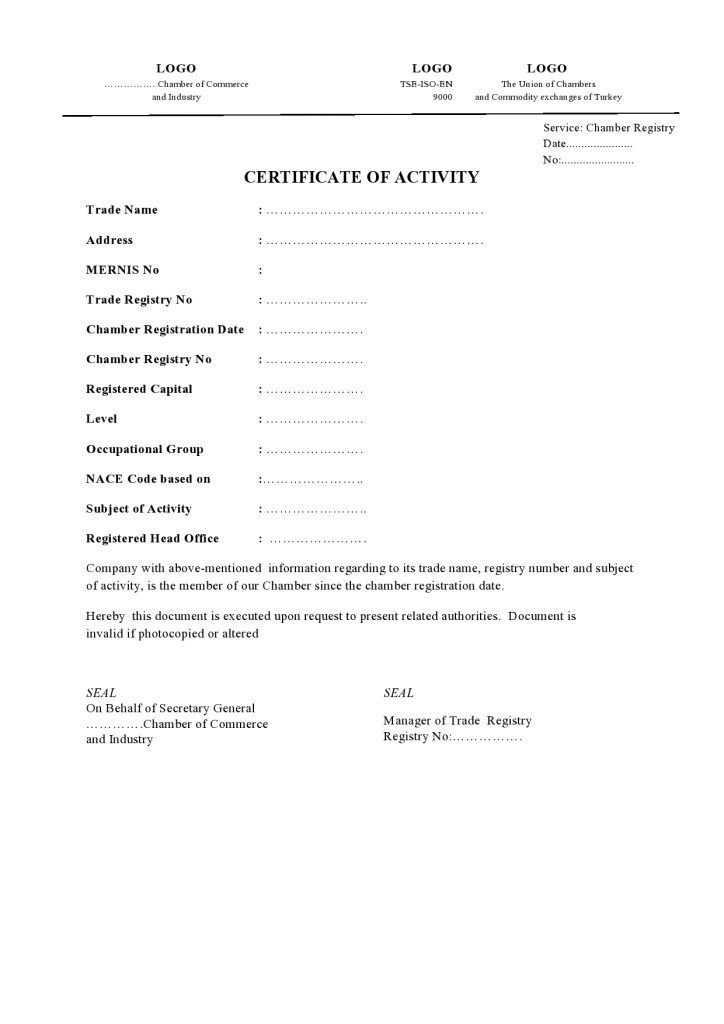

- If the foreign partner is a legal entity; notarized translation of the certificate of activity and registry certificate issued by the chamber of industry or commerce in which the company is registered or by authorized courts which is apostilled or certified by the Turkish Consulate,

- Notarized and translated Power of attorney given to the real person who will carry out the founding procedures,

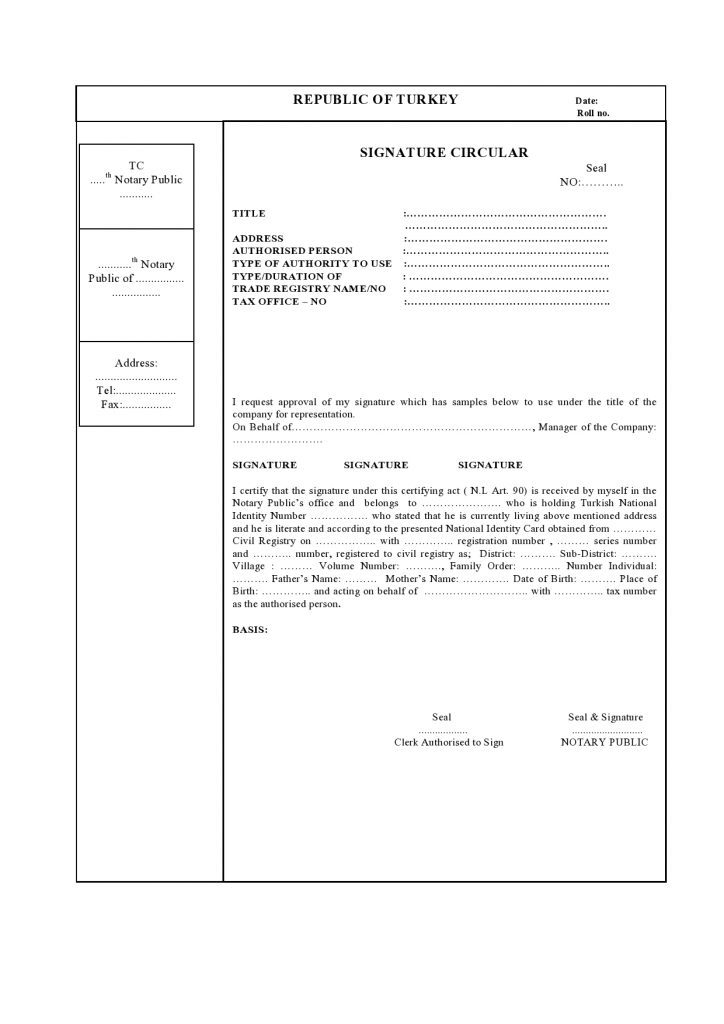

- Statement of the signatures of the company officials under the company titles which is certified by the notary (registration request),

- Stamped and signed bank receipts if collected,

- Stamped and signed bank receipt showing that the four per ten thousand of the capital is deposited in the account of Competition Authority,

- Chamber of Commerce registry statement

As you can see at this point, since the original documents to be submitted for real persons who are citizens of foreign countries and legal entities resident in such countries would be drawn up abroad, these documents must be apostilled and translations thereof must be certified by the consulate or notary public. Potential tax number must be taken from the tax office for company partners who are not Turkish citizen.

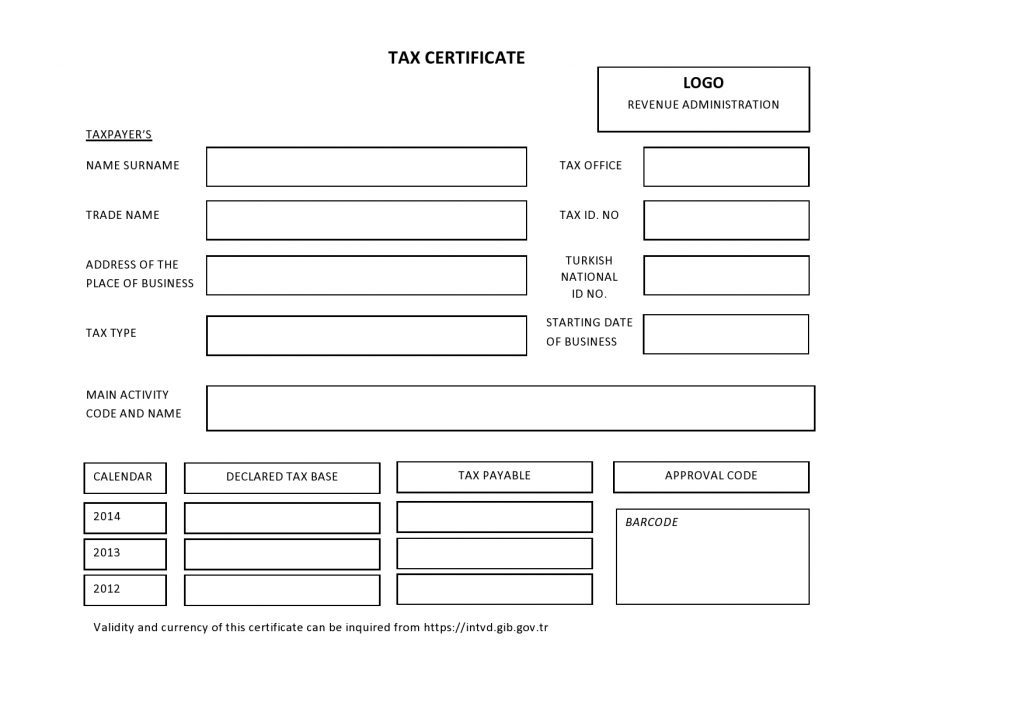

After completing these transactions, the company will have legal entity following the registration by the trade registry office. Then, transactions may be carried out such as drawing up a statement of signature for the director or representative, certification of books, obtaining tax certificate. In addition, Trade Registry Offices send a copy of the “Company or Branch Founding Statement”, a copy of any modifications in the articles of association which are subject to company registration and announcement and a copy of the submitted “Partners List” or “Attendance Sheet” to the Ministry of Economy.

In addition, the companies with foreign capital are obliged to notify to General Directorate of Incentive Practices and Foreign Capital the information in relation to their capitals and activities within the framework of “Activity Information Form for Direct Foreign Investments” on annual basis and until the end of May each year; information regarding payments to capital account within the framework of “Capital Information Form for Direct Foreign Investments” within 1 month following the payments and the information regarding the transfer of shares by current local and foreign partners among themselves or any local or foreign investment outside the company within the framework of “Transfer of Share Information Form for Direct Foreign Investments” and within maximum 1 month following the transfer of shares

COMPANIES SUBJECTED TO THE APPROVAL OF MINISTRY

The following types of Joint Stock Companies are subjected to prior permission of Ministry before their establishment and/or the amendment of their articles of incorporation.

- Banks,

- Financial leasing companies,

- Factoring companies,

- Consumer finance and card services companies,

- Asset management companies,

- Insurance companies,

- Joint-stock company established in the form of holdings,

- Companies operating currency exchange office,

- Companies dealing with public warehousing,

- Companies dealing with licensed warehousing of agricultural products,

- Commodity exchange companies,

- Independent audit companies,

- Surveillance companies,

- Technology development zone administrator companies,

- Companies founding and operating Free Trade Zone.

TYPES OF COMPANIES & REQUIRED DOCUMENTS

As per article 124 of the new commercial code incorporated companies are listed as Collective Company, Commandite Company, Joints Stock Company, Limited Company and Cooperative. In accordance with the second paragraph of the Article 124, Commandite (Limited Partnership) and Collective companies are classified as partnerships and the Joint Stock Companies, Limited Liability Companies and Limited partnership by shares are classified as Capital Companies.

Figure 1: TYPES OF COMPANIES IN TURKEY

COMPANY TYPES AND CHARACTERISTICS | ||||||

| COMPANY TYPE | LEGAL ENTITY | RESPONSIBILITY | STRUCTURE | PARTNERS | CLASSIFICATION | TAX LIABILITY |

| SOLE PROPRIETORSHIP | NO | UNLIMITED LIABILITY | AT LEAST ONE SHAREHOLDER | NATURAL PERSON | PROPRIETORSHIP | INCOME TAX |

| UNINCORPORATED COMPANY | NO | UNLIMITED LIABILITY | AT LEAST TWO SHAREHOLDERS, | NATURAL PERSON | PROPRIETORSHIP | INCOME TAX |

| COLLECTIVE COMPANY(GENERAL PARTNERSHIP) | YES | UNLIMITED LIABILITY | AT LEAST TWO SHAREHOLDERS, | NATURAL PERSON | PROPRIETORSHIP | INCOME TAX |

| COMMANDITE COMPANY (LIMITED PARTNERSHIP) | YES | ACTIVE PARTNER (COMMANDITE) HAS UNLIMITED LIABILITY | AT LEAST TWO SHAREHOLDERS, | ACTIVE PARTNER SHOULD BE NATURAL PERSON | PROPRIETORSHIP | INCOME TAX |

| LIMITED PARTNERSHIP BY SHARES | YES | ACTIVE PARTNER (COMMANDITE) HAS UNLIMITED LIABILITY | AT LEAST FIVE SHAREHOLDERS, | ACTIVE PARTNER SHOULD BE NATURAL PERSON | CAPITAL COMPANY | CORPORATE TAX |

| LIMITED LIABILITY COMPANY | YES | LIMITED LIABILITY | AT LEAST ONE SHAREHOLDER, MINIMUM AMOUNT OF CAPITAL SHOULD BE 10.000 TURKISH LIRAS | NATURAL PERSON OR LEGAL ENTITY | CAPITAL COMPANY | CORPORATE TAX |

| JOINT STOCK COMPANY | YES | LIMITED LIABILIY | AT LEAST ONE SHAREHOLDER, MINIMUM AMOUNT OF CAPITAL SHOULD BE 50.000 TURKISH LIRAS | NATURAL PERSON OR LEGAL ENTITY | CAPITAL COMPANY | CORPORATE TAX |

Table 1: COMPANY TYPES AND CHARACTERISTICS

LIMITED LIABILITY COMPANY (LLC)

As per article 573 of the Turkish Commercial Code, a limited liability company can be formed by at least one natural person and a legal entity shareholder for all the kinds of economic purposes. The number of shareholders can not exceed 50. Shareholders are not responsible for the debt of the company; they are only responsible for paying basic capital shares to which they are subscribed. The registered capital of the Limited Liability Company should be at least 10.000 Turkish Liras.

Table 2: LIMITED COMPANY – REQUIRED DOCUMENTS

JOINT STOCK COMPANY (J.S.C)

In accordance with article 239 of Turkish Commercial Code, “A joint stock company is a company whose capital is certain and divided into shares and which is solely responsible for its debts as an amount of its assets. Shareholders are solely responsible to the company and their responsibility is limited to their subscribed shares.” Minimum capital of the joint stock company should be at least 50.000 Turkish Liras.

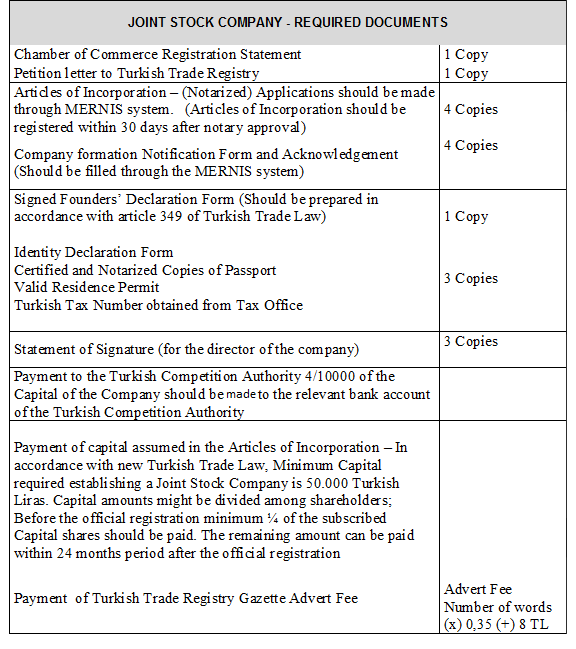

Table 3: JOINT STOCK COMPANY – REQUIRED DOCUMENTS

COMMANDITE & COLLECTIVE COMPANY

Article 304 of Turkish Commercial Code defines Commandite Companies. Accordingly Commandite Company is a form of company established for commercial purposes under a trade name. The liability of some shareholders is limited to the subscribed capital (Commanditer), on the other hand for some shareholders have unlimited liability (Commandite). No minimum capital is required for the formation of a commandite company.

As per article 211 of Turkish Commercial Code (General Partnership) can be founded by real persons for commercial purposes under a trade name. In the collective company, shareholders have unlimited liability.

Table 4: COMMANDITE & COLLECTIVE COMPANY – REQUIRED DOCUMENTS

ANNEXES – SAMPLE DOCUMENTS

ANNEX I SAMPLE CERTIFICATE OF ACTIVITY

ANNEX II SAMPLE CERTIFICATE OF PARTNERSHIP CONFIRMATION

ANNEX III SAMPLE CERTIFICATE OF CHAMBER REGISTRY

ANNEX IV SAMPLE SIGNATURE CIRCULAR

ANNEX V TAX CERTIFICATE

DISCLAIMER

Please consider that Expat Guide Turkey guide – Establishing Business in Turkey – contains general information only, not legal advice. Although Expat Guide Turkey & Ata Kurumsal has taken great care in compiling the content of this guide, we cannot guarantee that all information is accurate and complete.Expat Guide Turkey accepts no liability for the content of this guide, or for the consequences of any actions taken on the basis of the information provided.

-Valuation of firm’s assets

- Determination of the movable and immovable asset registered to the legal entity of the business and the monitoring of purchases and sales processes.

-Providing services on Tax Offices and Social Security Offices for the establishment and the operation of the company

- Initiation and monitoring of the processes to establish a company or to open a branch in Turkey by foreign-owned company at the Social security institute and Turkish Taxes.

-Selection for suitable accounting software for firms and integration in the service

- Assisting and determining to choose the most suitable accounting software in accordance to the operation and sector of the company in Turkey.

-Audit service for inspecting accounting records according to tax laws and accounting standards

- Registering and examining all the activities of the foreign-owned companies to check whether it is in accordance with the legislation.

-Accounting according to Turkish Tax Laws and accounting standards and preparing all the tax returns necessary for monthly, quarterly and yearly periods

- Preparation of mandatory tax declaration in accordance with the legislation and notify the tax declaration in the relevant İnstitutions .

-Bookkeeping according to Turkish Commercial Law, Tax Procedure Law and The Uniform Chart Of Accounts published by the Ministry of Finance

-Bookkeeping according to report format of the main company, preparing reports for monthly or yearly term

-Service for interpreting financial reports of third parties

- Analysis of financial data of the potential business partner of the foreign-owned company to provide relevant information for decision making processes.

-Preparing and presenting accounting reports in foreign languages for international company headquarters

-Accounting for liaison offices of international companies and preparing treasury reports

Prices

| The Company’s Paid-in Capital is less than 100.000 TL | Company’s Paid-in Capital 100.000 TL | The Company’s Paid-in Capital is more than 100.000 TL | Company’s Paid-in Capital $ 2,000,000 | |

| Charge | 2.000 $ + VAT | 5.000 $ + VAT | 6.000 $ + VAT | 10.000 $ + VAT |

| Company Establishment | √ | √ | √ | √ |

| Chamber of Commerce Registration | √ | √ | √ | √ |

| Establish, Taxes and Fees | √ | √ | √ | √ |

| Residence Permit | √ | √ | √ | √ |

| Work Permit | × | √ | √ | √ |

| Accounting and Payroll Service (1 Year) | × | √ | √ | √ |

| Other Business Documents | × | × | √ | √ |

| Relocation (1 Year) | × | × | √ | √ |

| Legal Consultancy (1 Year) | × | × | √ | √ |

| Turkish Citizenship and Turkish Passport | × | × | × | √ |